owner's draw in quickbooks self employed

What Makes QuickBooks Self. You should already have an owners draw account if you selected sole proprietor when setting up quickbooks.

Learn About The Chart Of Accounts In Quickbooks Online

Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria.

. For background our company used Quickbooks Enterprise for. An owners draw account is an equity account used by QuickBooks Online to track withdrawals of the companys assets to pay an owner. Select Petty Cash or Owners.

Now hit on the Chart of Accounts option. Click the Banking tab in the main menu bar at the top of the screen. 1 Best-Selling Tax Prep Software.

Here are few steps given to set up the owners draw in QuickBooks Online. Open the QuickBooks Online application and click on the Gear sign. Follow these steps to set up and pay the.

Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner. To Write A Check From An Owners Draw Account the steps are as follows. Close Your Books Faster Today.

Take 50 Off QuickBooks w Verified Coupon Code. 1 Best-Selling Tax Prep Software. Business owners generally take draws by writing a check to themselves from their business bank accounts.

Answer 1 of 5. Type the owners name if you want to record the withdrawal in the Owners Draw account. Download Now Save More.

For accounting purposes the draw is taken as a negative from their business. Click on the Banking menu option. Ad QuickBooks Online Official Site.

Step 4 Click the Account field drop-down menu in the Expenses tab. Ad QuickBooks Online Official Site. Ad Create Invoices Track Payments And Get Paid 2x Faster With QuickBooks.

Then choose the option Write Checks. Easy Supplier Management PO Matching. What is Up in Quickbooks Self-Employed Basics for Business Owners Online.

If not go to your chart of accounts to create a new account and. If QuickBooks displays the Payments to Deposit. If you are self-employed sole proprietor or disregarded single-member LLC you are going to be taxed on all of your business earnings whether you take a draw or leave the.

In QuickBooks Desktop software. Global Payables Automation Software Built For QBO. As a business owner you are required to track each time you take money from your business profits as a draw or owner salary payment for the purpose of calculating the.

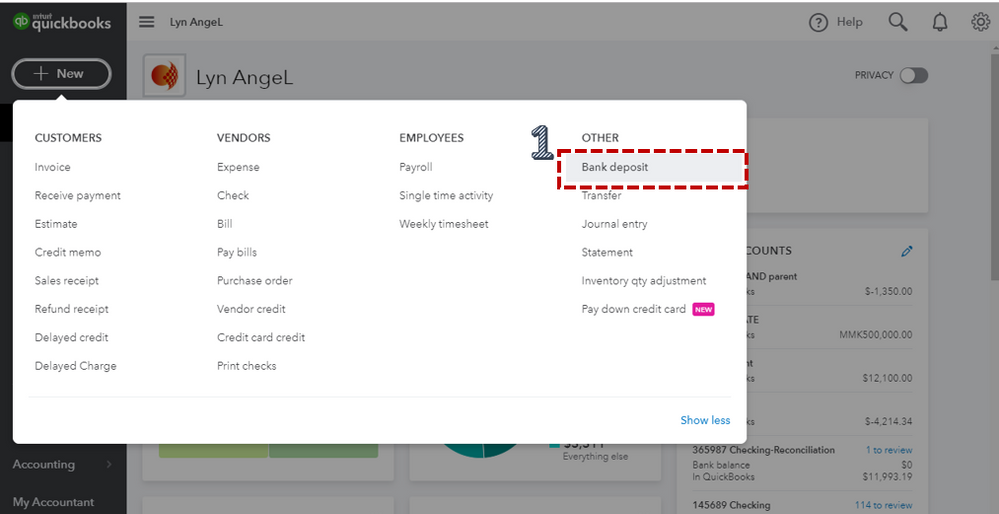

Select Make Deposits from the drop-down menu. Ad QBO Integrated AP Automation Program.

Accounting Cheat Sheet Pdf Debits And Credits Depreciation Learn Accounting Accounting Accounting Education

Learn About Money Market Accounts Not Your Typical Accounts Personal Finance In 2022 Finances Money Personal Finance Finance

222 Catchy Bookkeeping Slogans And Taglines Business Slogans Bookkeeping Business Bookeeping Business

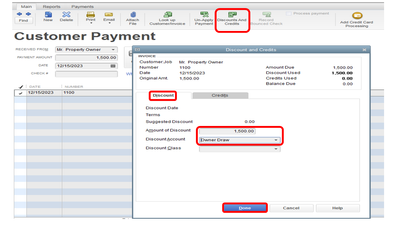

How To Pay Invoices Using Owner S Draw

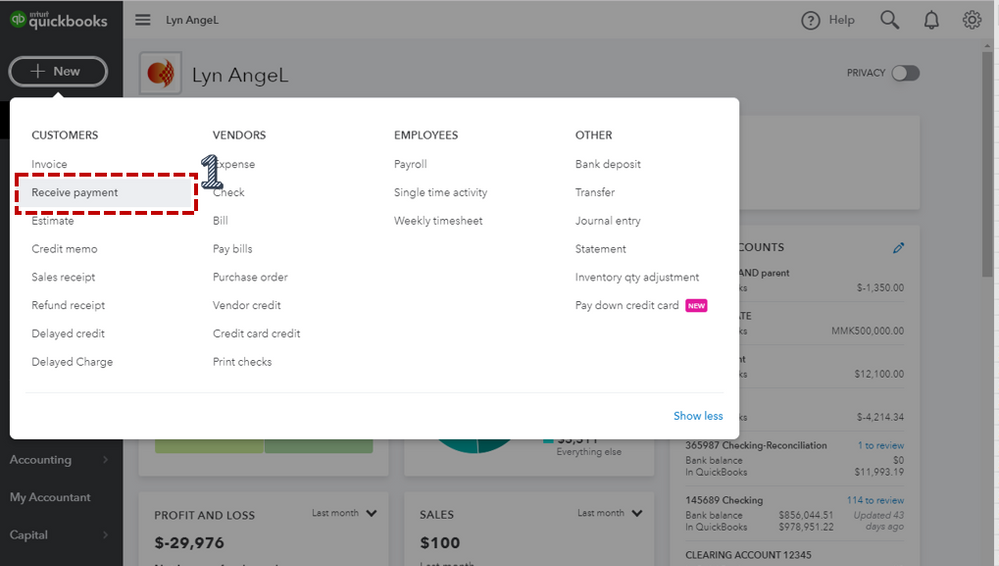

How Do I Pay Myself Owner Draw Using Direct Deposit

Learn About The Chart Of Accounts In Quickbooks Online

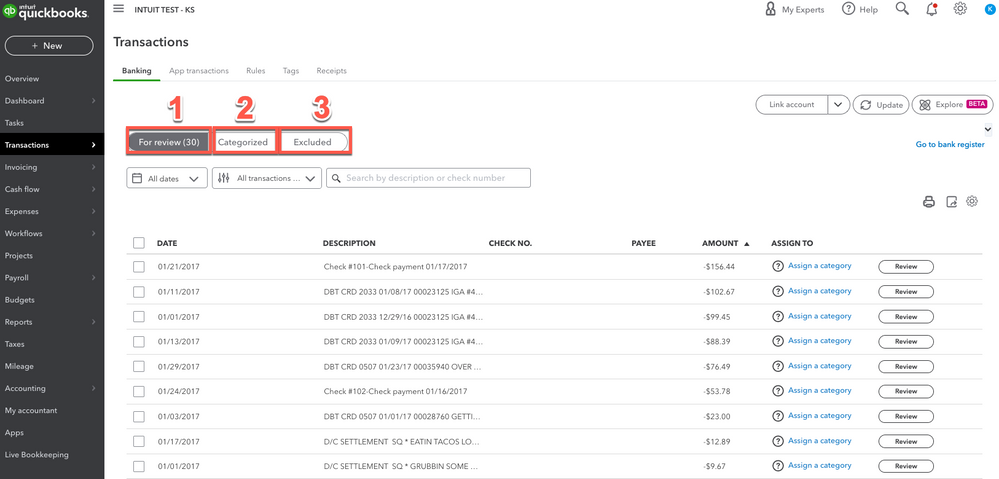

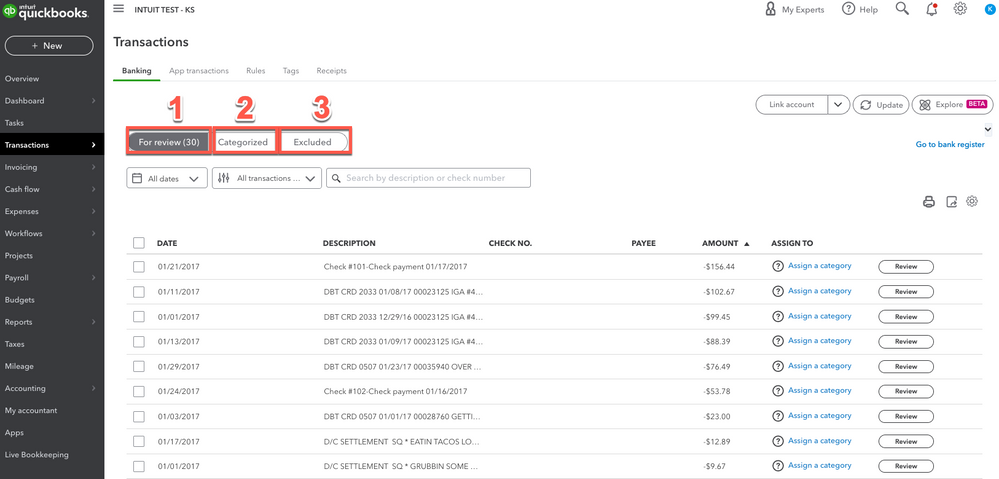

Connect And Review Your Banking In Quickbooks Online

Solved What Is The Best Way To Record A Customer Prepayment And Deposit

Connect And Review Your Banking In Quickbooks Online

Accounting Chart Shows Balancing The Books And Accountant Stock Illustration Stock Illustration Royalty Free Illust Accounting Accounting Books Stock Photos

How To Pay Invoices Using Owner S Draw

Free Excel Cash Book Template For Small Business Bookkeeping Templates Spreadsheet Template Excel Templates

Free Excel Cash Book Template For Small Business Bookkeeping Templates Spreadsheet Template Excel Templates

Does My Llc Need To File A Tax Return Even If It Had No Activity

Disney Aladdin Genie Birthday 6 Youth T Shirt Blue Job Interview Tips Job Interview Preparation Interview Tips

How Do I Pay Myself Owner Draw Using Direct Deposit

This Annual Tax Reference Guide Is For Any Business That Has Employees And Contractor Bookkeeping Business Small Business Accounting Small Business Bookkeeping